A Lithuanian company where the majority of capital is owned by a foreign company is called a subsidiary. Foreign companies choose this type of company instead of branches because of the limited liability obtained by the foreign shareholder and because of the tax incentives offered, especially for companies coming from countries which have signed double tax treaties with Lithuania.

The withholding tax on dividends, interests and royalties paid to the foreign companies may be exempt or minimized by the provisions of such treaties. Our company formation agents in Lithuania can help with the registration of a subsidiary in this country.

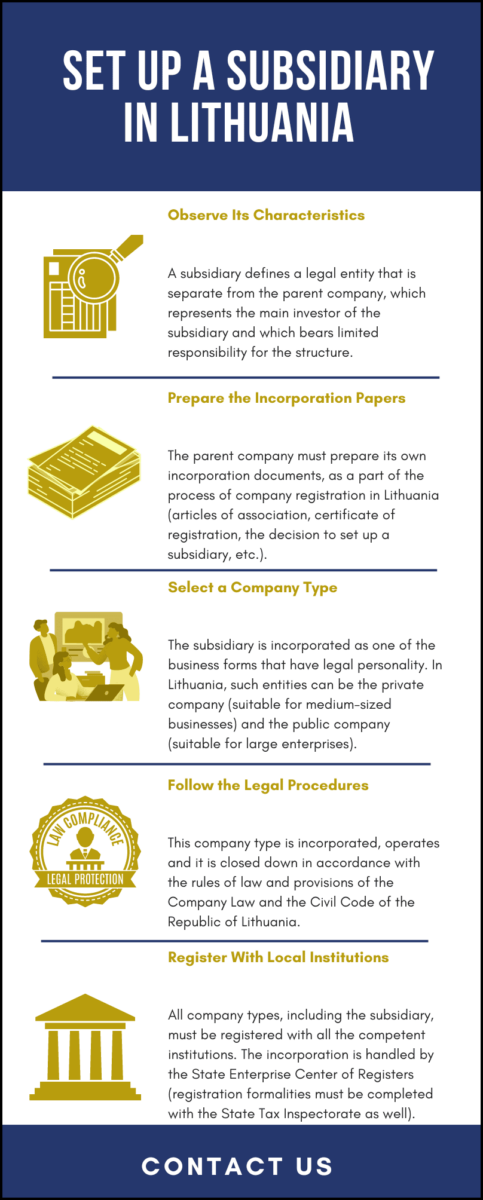

Why open a subsidiary in Lithuania?

A subsidiary established in Lithuania is considered a legal entity, so it can acquire real estate property, hire personnel and conclude contracts without the approval of the foreign company. The most common form a subsidiary takes in the Republic of Lithuania is the private company.

| Quick Facts | |

|---|---|

| Definition of a subsidiary | A subsidiary is a legal entity that has its own legal personality and which is independent from the parent company that set it up. The latter is also the main shareholder of the subsidiary, owning at least 51% of the shares. |

|

The main characteristics of a subsidiary |

An independent legal entity that has the right to own various assets, including property. It does not need the approval of the parent company on management matters, or owning property and assets. It is set up as one of the legal entities available in Lithuania and it is liable for corporate taxation as per the Lithuanian tax laws. |

|

Law applicable to subsidiaries |

– Company Law, – Civil Code of the Republic of Lithuania. |

| Documents necessary to establish a subsidiary in Lithuania |

– information on the parent company from the institutions operating in the home country of the parent company, – the parent company’s incorporation papers, – the declaration of the parent company for the set up of the subsidiary in Lithuania, – the incorporation documents of the subsidiary, – details on the business address of the subsidiary, – information on the appointed representatives. |

| Capital requirements (yes/no) |

Yes |

| Company types for subsidiaries |

– private company, – public company |

| Registration institutions |

– State Tax Inspectorate, – State Insurance Fund Board, – State Enterprise Center of Registers. |

| Duration of the process to establish a subsidiary in Lithuania |

Approximately 1 month. |

| Taxes imposed to Lithuanian subsidiaries |

– the corporate tax, – the value added tax, – withholding taxes, – employment taxes. |

| Notary public procedures (yes/no) | Yes |

| EU Parent-Subsidiary Directive applicable in Lithuania (yes/no) |

Yes |

| Minimum capital |

EUR 2,500 (private company)/ EUR 40,000 (public company) |

| Parties involved in the registration process |

– Lithuanian notary public, – Lithuanian registration institutions, – our specialists in company formation in Lithuania, – company representatives. |

| Main incorporation steps |

– preparing the registration documents, – selecting a suitable legal entity, – preparing the incorporation documents for the desired legal entity, – opening a corporate bank account, – depositing the minimum share capital, – providing evidence on having a registered address in Lithuania, – registering for taxation with the State Tax Inspectorate, – obtain a tax identification number, – registering for employment. |

| Incorporation services offered by our consultants | Our consultants can help you establish a subsidiary in Lithuania by offering assistance in any of the incorporation steps mentioned above, as well as full assistance in post-incorporation matters, such as tax compliance and accounting. |

It can be formed by one or more founders, but the maximum number of shareholders cannot exceed 250. A minimum share capital of LTL 10,000 must be deposited by this form of business in a bank account. The liability of the shareholders is limited by the contribution to the capital.

The management bodies’ members of the company are nominated by the general shareholders meeting. The public companies are usually formed by one or more shareholders and consist in an unlimited number of shareholders. The minimum registered capital in a public company is LTL150,000 that must be deposited in a bank account. The management of this type of company is assured by the management board, elected by the general meeting of the shareholders.

All information concerning the private limited liability company must be registered with the Register of Legal Entities. Please know that starting with 2010, the law stipulates that this type of company is legally required to provide information on the current list of shareholders and of course, of any modifications brought to the initial data on the shareholding of the company.

Documents related to opening a Lithuanian subsidiary

In order to be able to open a company in Lithuania as a subsidiary, it is required to prepare a set of documents; this requirement is necessary for all company types, but the types of documents one has to prepare will vary depending on the selected entity. The following documents are necessary when opening a subsidiary in Lithuania:

- • a declaration of the parent company’s owners acknowledging the opening of the subsidiary;

- • information about the parent company issued by the Trade Register in its home country;

- • the statutory documents of the subsidiary which must be drafted and notarized by a Lithuanian public notary;

- • information about the legal address and the local representatives of the subsidiary.

Our Lithuanian company formation advisors can assist with the preparation of the documents needed to set up a subsidiary. You can rely on our team of consultants in company formation in Lithuania for any of the steps involved in the registration of a local subsidiary.

Steps for opening a subsidiary in Lithuania in 2024

The registration of a subsidiary in Lithuania begins by opening the bank account and depositing the capital. The founder must deposit it at the Company Register, at the State Tax Inspectorate (for VAT and corporate tax) and at the State Insurance Fund Board. As a result, the subsidiary opened in Lithuania will receive a VAT number, a tax identification number, a certificate of registration and a unique registration number.

Next, the company must open a bank account for the normal commercial operations and obtain the official seal of the subsidiary. The process of registration a Lithuanian subsidiary takes about 22 days from the moment of opening the bank account to the moment of obtaining the company’s seal.

With regards to the steps on company formation in Lithuania that refer to setting up a bank account, local and foreign investors should be aware that the Company Law was last modified in 2020 and new provisions became applicable starting with 2021. Thus, one should know that, since January 2021, companies in Lithuania can also set up their bank accounts not only at local commercial banks, but also at the local licensed e-money institutions; in the first quarter of 2022, there were 88 such entities.

This regulation is also available in 2024.

We invite you to watch a short video on how to establish a subsidiary in Lithuania:

How can one open a private company in Lithuania in 2024?

As said above, the subsidiary is incorporated under the form of a company type that is recognized under the Lithuanian law. Most common entity selected for this purpose is the private company, as it can be set up by both small and medium-sized companies and, given that it provides a set of advantages to its founders, it is a preferred way to register a subsidiary.

When starting a private company, the State Enterprise Center of Registers, which deals with gathering information on local companies, as well as on local properties, investors will start the procedure by selecting the basic characteristics of the company (the company is set up by a single natural person, by a single corporate entity, by more investors, it will operate as a financial/insurance/commercial bank entity, these being few of the main basic traits that the private company can have).

If you want to open a Lithuanian companyas a private company, then the main rules of law which must be followed in this case are the Company Law and the Civil Code of the Republic of Lithuania (Book Two). Its establishment is bound by the accomplishment of a set of requirements, which will be evidenced in the list below:

- • the registration starts by completing the Form JAR-5, in which the investors will also select a company name;

- • they must also deposit the minimum share capital, which is established at EUR 2,500 (or approximately LTL 10,000);

- • where there are more shareholders, each of them must pay 25% of the capital;

- • the registration also includes a registration fee, which, in the previous years, was established at the standard value of EUR 57,34.

For the financial year 2024, the registration fee for a limited liability company is of EUR 30,83. This is the standard fee regardless if the founder is a natural person or a legal entity. It must be noted that the fees charged for company registration in Lithuania vary based on the company type to be registered.

For instance, the registration of a branch office of a foreign company is bound by the payment of a fee of EUR 41,75, while the registration of a branch set up by a Lithuanian-incorporated business costs EUR 26,57.

The steps for company incorporation in Lithuania must include the drafting and signing of the articles of association of the company (procedure applicable where there are more founders). In the case in which the company is set up by a single investor, then the statutory documents are represented by the act of establishment.

The articles of association are very important documents, not only due to the fact that the company will gain legal recognition through them, but also because other registration procedures require presenting the statutory documents. The document is required when establishing the bank account, for instance.

The same steps have to be followed when starting the process of company registration in Lithuania for a public limited company, with the difference that the company will have larger capital requirements and that the number of investors is not limited. This business form is addressed to large companies wishing to expand on the Lithuanian market.

Accounting requirements applicable to subsidiaries in Lithuania

All companies must prepare specific accounting documents, as per the requirements of the accounting laws recognized here. The set of documents that have to be submitted with the financial institutions will vary from one company type to another. From an accounting point of view, Lithuanian subsidiaries:

- must comply with the local legislation, as they are considered Lithuanian tax residents;

- they will be applied the corporate tax which is levied at a rate of 15%;

- they must register with the local authorities in order to be able to make and receive payments;

- they must file VAT returns on a monthly basis and tax returns annually.

As we mentioned above, the standard corporate tax in Lithuania is charged at the rate of 15%, but there are certain exemptions from this rule, which grant the opportunity to be taxed for corporate income at much lower rates. For instance, small companies, as well as companies which operate in the agricultural industry, can benefit from a reduced corporate tax rate of 0% or 5%.

However, the right to benefit from these reduced corporate tax rates is applicable if certain conditions are met, which can be detailed by our consultants in company registration in Lithuania. You can address to our team for information on other tax benefits that can apply to local businesses.

It is also important to know that by the end of 2022, a special corporate tax, charged at the rate of 20%, was applied to credit institutions. This rate applied for any income above the threshold of EUR 2 million.

Please mind that starting with 1 January 2023, the Law on Corporate Income Tax introduced new amendments concerning the taxation of hybrid entities.

With regards to the reduced corporate taxes, of 0% and 5%, they are charged to small companies, as long as they employ less than 10 employees and the annual revenue is below EUR 300,000 – the regulation is maintained in 2024. The 0% tax is charged for the first year of business activity and the 5% tax rate is applied for the following years, as long as the two conditions mentioned here are maintained. For assistance in establishing a subsidiary, please contact our company registration consultants in Lithuania.