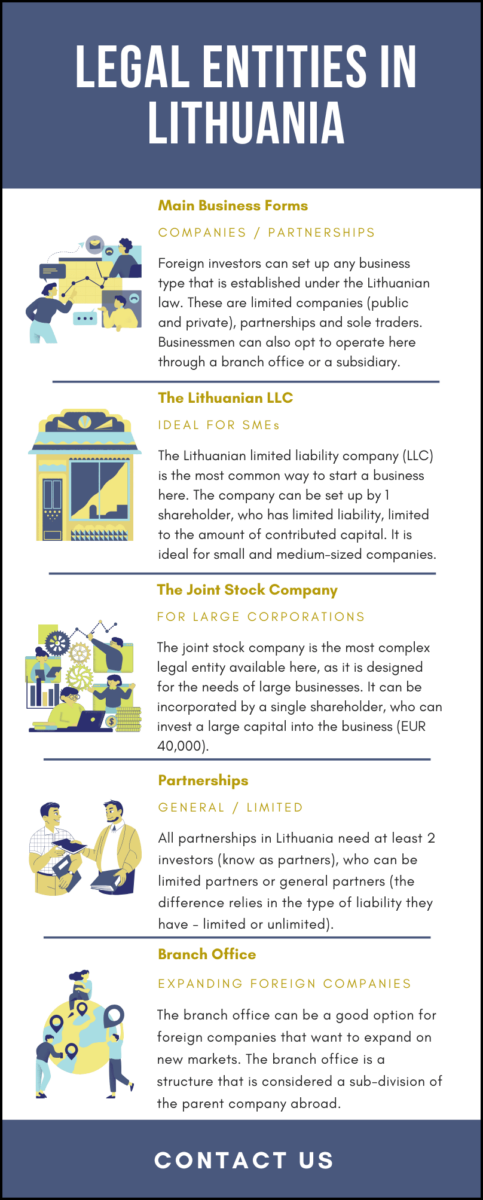

There are many types of companies in Lithuania that investors can incorporate. They can be the limited liability company, the joint stock company, the sole trader or partnerships. Investors can also operate here through a branch office.

Lithuania represents one of the countries that are member states of the European Union (EU) that provides suitable investment policies for investors around the world, and this has had a positive impact on the overall foreign investments concluded here.

It is estimated that, on a yearly basis, the local registration authorities receive approximately 2,000 requests for the incorporation of small and medium sized companies (SMEs).

Local and foreign businessmen who want to start a business in Lithuania will have to follow the regulations prescribed by the Commercial Code, and in this sense, one of the first steps that have to be completed is to select a suitable company type for their future business activity. Our company formation agents in Lithuania can help you choose the right type of entity based on your needs and activities.

What are the main types of companies available for registration in Lithuania?

According to the Company Law, foreign investors can register any of the following legal entities: the sole proprietorship, the private limited liability company, shortly known as the UAB, the public limited liability company or the AB, and the partnership, which can be general or limited and known as the KUB.

| Quick Facts | |

|---|---|

| Types of legal entities in Lithuania | The limited liability company, the public limited company, the partnership, the branch office, the sole trader. |

|

The characteristics of the LLC |

One of the company types in Lithuania is the limited liability company (UAB), which has the following characteristics: – ideal for small and medium-sized companies; – it can be set up by 1 shareholder; – it provides limited liability against corporate debts; – minimum capital of EUR 1,000; – suitable for most business activities; – no nationality restrictions. |

|

The characteristics of the stock company |

The joint stock company (AB) is suitable for large businesses which can invest a capital of at least EUR 40,000. The company can be founded by 1 shareholder, of any nationality. |

| The characteristics of the partnership |

A partnership can be set up as general or limited. It needs at least 2 partners and it can be registered without a share capital. |

| The characteristics of the sole trader |

The sole trader must be incorporated by only 1 founder, who must be a natural person. There isn’t any legal distinction between the investor and the business and the entity is addressed solely to those who have their residency in Lithuania. |

| The characteristics of the branch |

The branch office is a business type that is set up by a parent company abroad, with the purpose of developing the same business model implemented by the parent. The parent company holds full responsibility for the activities of the branch. |

| Legislation regulating company incorporation in Lithuania |

Law on Companies |

| Corporate taxes |

Company types in Lithuania can be charged with the following: – the corporate income tax (standard rate 15%, reduced rates of 0% and 5% for small companies, 20% for financial companies); – VAT 21% (reduced 0%, 5%, 9%); – social security contributions (1,77% – the employer, 19,5% – the employee). |

| Foreign ownership rules |

The local legislation offers foreign investors similar ownership rights as the ones available for Lithuanian citizens (certain limitations can appear in specific fields). |

| Double tax treaties signed by Lithuania | 58 |

| Main company registration steps |

Investors have to select a company type that is most suitable to their activity, register a trade name, have a business address and complete mandatory registration with the Lithuanian institutions. |

| Corporate tax number required (yes/no) |

Yes |

| Resident director/shareholder requirements |

There aren’t any residency requirements. |

| Can investors modify the legal entity of a Lithuanian company? |

Yes |

| Ways in which our team can assist investors |

Our team can help investors register various company types in Lithuania. Foreigners can address us for assistance in business immigration formalities. We can also help you with tax registration and compliance. |

Foreign companies are also allowed to operate on the Lithuanian market through subsidiaries which are usually registered as limited liability companies, branch offices and liaison or representative offices.

The sole proprietorship in Lithuania

The sole proprietorship or sole trader is registered by an individual who must be a natural person. As a founder, he or she will bear unlimited liability for the business’ debts.

There is no minimum share capital request. In order to open a sole proprietorship, here are the main steps that must be followed: make the necessary arrangements for company name reservation with the Public Institution Register Centre, prepare the personal documents of the investor and have a registered business address.

Limited liability companies in Lithuania

If an investor has available a sum of EUR 1,000, he or she may open a private limited liability company. The Lithuanian UAB can be registered by a single shareholder, who will benefit from limited liability against corporate debts.

The limited liability company is the most employed type of company in Lithuania thanks to the low share capital requirements and the less stringent shareholding requisites. At least 25% of the share capital must be deposited upon the formation of a limited liability company in Lithuania.

The Law on Companies has been modified in 2023, by including more up-to-date amendments concerning the registration of legal entities, with the purpose of creating a more favorable investment regime for local and foreign businessmen. Below, our consultants in company formation in Lithuania present the most important modifications concerning this company type:

- the new amendments of the Law on Companies have been introduced starting with 1 May 2023;

- starting with this date, investors who want to open a company in Lithuania as a limited liability company can register it with a capital of EUR 1,000 instead of the previous requirement, of EUR 2,500;

- shareholders who own at least 10% of the shares can request the right to vote in shareholders’ meetings remotely, by using electronic means of communication;

- the minutes of the meeting can be signed within a period of 7 days since the meeting took place (electronic signatures are also possible now);

- where digital signatures are used, they must comply with the rules of Article 14 of the EU Regulation No. 910/2014;

- if a shareholder owns at least 95% of the shares of the company, then he or she can be entitled to ask the other shareholder (shareholders) to sell their voting shares.

If the latter case happens, the majority shareholder, owning at least 95% of the shares, can purchase the remaining shares from the other shareholders. There are other new regulations that have been introduced and which concern the registration and the management of the limited liability company, therefore we invite you to find out more from our specialists in company registration in Lithuania.

With regards to the registration of a limited liability company in Lithuania, our specialists have prepared a short presentation with the main steps that you should follow during the incorporation process. Mind that all investors will have to complete the same steps when opening a Lithuanian company:

- investors will have to open a corporate bank account, where they will deposit the company’s capital – the procedure can be completed in one day;

- then, you have to obtain an electronic signature – this step can be completed through several online options;

- find a suitable trading name and, if available, register it (please mind that this will impose the payment of a small fee);

- you also have to register the company for taxation purposes and for this, a large number or corporate documents have to be prepared and signed (the articles of association, the founding act, the minutes of statutory meeting and others);

- register for value added tax – the obligation to register is applicable to all companies if they have an annual turnover above EUR 55,000 (requirement imposed starting with 1 January 2024, a date when the VAT registration threshold has been increased from the previous threshold of EUR 45,000);

- go to a local bank and register a settlement bank account, necessary for daily corporate transactions.

Businessmen who dispose of a larger capital may open a public limited liability company. The minimum amount of money required to set up an AB in Lithuania is EUR 25,000 (reduced starting with 2023), out of which 25% must be deposited upon incorporation.

The members’ liability is limited to their contribution. The important decisions related to the company are taken during the General Meeting of the Shareholders, and in this sense, the investors will also have to appoint a Board of Management.

The registration of this legal entity starts by completing the Form JAR-5 with the Register of Legal Entities. Please know that the procedure of company registration in Lithuania imposes the payment of a small registration fee, which, for this legal entity is EUR 30,83.

It is necessary to verify the conditions stipulated by the institutions concerning the payment of fees as each company type can be charged with a different fee. You can also address our consultants, who can assist you during the process of Lithuania company formation and who can present you with the current fees you will be asked to pay. We also invite you to watch a short video on the legal entities in Lithuania:

VAT registration obligations in Lithuania

Considering that above we have presented an important modification concerning VAT registration, we want to provide additional information concerning VAT matters, as these are very important for investors who opted to open a company in Lithuania.

Therefore, we also mention that VAT registration formalities are mandatory for companies that are not incorporated in Lithuania, but which develop commercial activities on the territory of Lithuania, by selling goods or services to Lithuanian residents. According to the law, the registration is mandatory, in this case, when the company reaches a turnover threshold of EUR 10,000.

It must also be observed that VAT registration obligations will derive from intra-community acquisitions, and the threshold here is EUR 14,000. Lithuania charges a standard VAT rate of 21%, but also reduced rates of 9%, 5% and 0% are available for specific classes of goods and services.

Partnerships in Lithuania

One of the partnerships that can be set up in Lithuania is the general partnership, which is founded based on a partnership agreement that is signed by at least two partners, who have equal liability and an equal contribution in the partnership. One should know that this company type can be incorporated without the need of depositing any share capital.

The general partners’ agreement must contain the following: the name of the partnership, information regarding the members, information regarding headquarters, the type of business, the procedure regarding the covering of the incorporation costs, the amount of contribution of each member, the duration of the company (when it is a temporary company) and the date of signing the agreement.

It must also contain information regarding the procedures for transferring the shares or on accepting new partners.

A limited partnership is formed by two or more members with different roles in the company, according to their financial contribution. There are the limited liability partners and the general partners with no limited liability and decisional power in the company.

An agreement must also be signed and the names of the general and limited partners have to be clearly seen in the document. In this type of partnership there aren’t any capital requirements as well.

If you want to open a company in Lithuania as a partnership, it is necessary to know that the partnership agreement has to contain information on other important matters, such as the ones mentioned below; if you need further advice on the incorporation of a partnership, please address to our team of consultants in company formation in Lithuania:

- the procedures the partners have to follow if and when they will transfer rights from one partner to another;

- the legal steps that have to be taken in the case in which the number of partners will increase and the manner in which the new partner will enter the partnership;

- the legal steps through which a partner will retire from his or her activities in the partnership;

- the procedure for establishing branches of the respective partnership, as well as the steps for their dissolution, when applicable;

- the procedure through which the partners can amend the initial partnership agreement that they have signed.

With regards to the manner in which the profits are distributed amongst the company’s partners, it is necessary to know that this is done at the end of the financial year, based on the decision of the general partner.

The distribution of the profits will be done based on the capital participation of each partner; if we refer to the income of the limited partner, the distribution of the profits will be limited to the regulations prescribed in the partnership agreement, in the section regulating the rights and obligations of the limited partner.

Branch and representative offices in Lithuania

Compared to the subsidiary, the branch office is linked to the parent company in terms of activities and control. A basic requirement for company formation in Lithuania in the case of a branch office is to assign a person who will act as the representative of the branch.

One can also open a company in Lithuania through a representative office or a liaison office, but in this case, the office will act just as a connecting entity between the foreign company abroad and the local market in Lithuania, with its customers and business partners.

The representative office cannot engage in any commercial activity, but it is required to have an office space in Lithuania. If you need other types of services, for example legal services in case of a drink driving offence, we can put you in contact with our partners.

What is the data on Lithuanian companies?

Lithuania is a small country, with a population of less than 3 million inhabitants, and this means that the number of companies it not that large also.

Those who want to open a company in Lithuania should know that the top industry sector in this country is the services sector, when we refer to the number of companies activating in this industry. Below, you can find important data on the companies operating in this country:

- Lithuania has a total of 165, 911 active companies;

- the largest industry is the services sector (based on the number of registered companies), accounting for 46,081 companies;

- the wholesale trade sector accounts for 18,946 companies or 11,4% of all the companies operating here;

- the retail trade accounts for a share of 9,8% of all the companies and this represents in absolute numbers a total of 16,195 companies;

- the transportation and communication businesses represent 8,4% of all the companies (or 13,950 legal entities);

- the manufacturing industry accounts for 7% of all companies, while the construction sector, for 6,4% (additional information on the local economy is available on the website of the Statistics Lithuania).

According to the latest data provided by the Register of Legal Entities, in 2023, in the 1st quarter, the institution registered 4,659 legal entities. In the 2nd quarter, there were 3,979 registrations, while in the 3rd quarter, there were 3,817 company registrations. In the 4th quarter of the year, there were 3,294 company registrations.

Company formation steps in Lithuania

The company registration process in Lithuania starts with a reservation for the trade name with the Centre of Registers, followed by the preparation and notarization of the company’s memorandum and articles of association. Following these, the next steps must be completed:

- opening the corporate bank account where the share capital is deposited;

- filing the incorporation documents together with information on the company’s shareholders and directors with the Trade Register;

- registering for corporate tax and for VAT purposes;

- registering for employment and social insurance purposes.

Once the Trade Register issues the Lithuanian company’s Certificate of Incorporation, the necessary business permits for operating must be obtained.

These are issued by specific authorities in the field of activity of the company. For more details on the legal entities that can be registered in this country, you can address our Lithuania company formation consultants. If you need advice on how to open a company in Lithuania, you can easily contact our team.