The Lithuanian taxation systemis based on direct taxes which are imposed on the incomes of Lithuanian citizens, residents and companies, but it also containsindirect taxes.

One of the indirect taxes is the value added tax, which is applied to the consumers of goods and services while being collected by the suppliers of those goods and services.

The value added tax in Lithuania falls under the law with the same name which was introduced in 1960 and which went under several modifications over the years.

The last amendment to the Value Added Tax Act was brought in 2002. Our company formation agents in Lithuania can offer more information on the VAT.

| Quick Facts | |

|---|---|

| We offer VAT registration services |

yes |

|

Standard rate |

21% |

|

Lower rates |

9%, 5%, 0% |

| Who needs VAT registration |

entities that supply goods and services in Lithuania, both resident and non-residents entities

|

| Time frame for registration | approximately 10 business days |

| VAT for real estate transactions |

21% (charged for the sale of a new property) |

| Exemptions available |

applies as per the rules of the Law on VAT (Articles 20-33) |

| Period for filing |

on the 25th of the month (on a monthly basis or bi-annual basis) |

| VAT returns support | yes |

| VAT refund | yes, applicable for both individuals and companies |

| Local tax agent required | no |

| Who collects the VAT | the State Tax Inspectorate |

| Documents for VAT registration | the articles of association of the company, the commercial register extract, the VAT certificate (the latter is necessary for foreign companies applying for a VAT number in Lithuania) |

| VAT number format | LT, followed by a combination of 9 digits of 12 digits |

| VAT de-registration situations | it is possible (the company stops its commercial activities, the value of the goods sold in a financial year was below EUR 35,000 for foreign entities involved in distance trade, the company enters the liquidation procedure or it is reorganized) |

What are the VAT registration obligations for foreign companies in Lithuania?

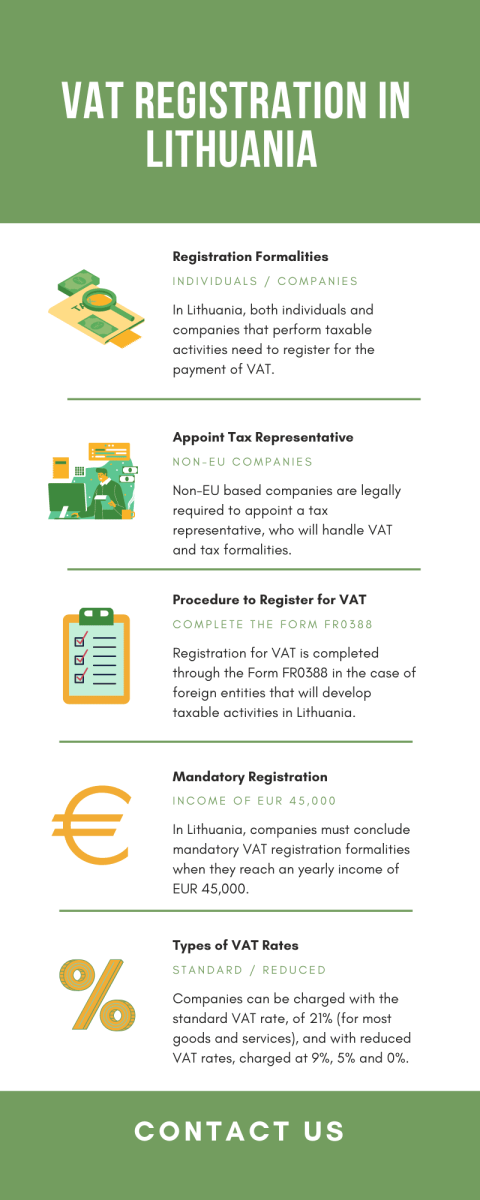

Taxable entities that develop commercial activities on the Lithuanian territory can be charged with the VAT regardless if they are incorporated in Lithuania or elsewhere.

However, the formalities that they have to comply with can differ based on the country of residence. Concerning the tax residency, there can be 3 main categories of companies, as follows:

- companies incorporated in Lithuania, developing commercial activities in Lithuania and in other countries;

- companies incorporated in member states of the European Union (EU), developing commercial activities in Lithuania;

- non-EU based companies, developing commercial activities in Lithuania.

For the 2nd and the 3rd category, different procedures will apply. For instance, EU companies in Lithuania are not required to appoint a tax representative in Lithuania when starting trading here.

On the opposite side, non-EU based companies must appoint a tax representative, as per the rules of the EU VAT Directives. For the latter, there can be an exemption from this rule.

This applies only as long as the non-EU based company is registered in a country that has signed a tax administration cooperation treaty with the Lithuanian authorities. Other than this, an agent will be required.

Our consultants in company registration in Lithuania can present additional information concerning this rule. Please mind that foreign companies must conduct registration procedures.

The procedure is completed with the Lithuanian State Tax Inspectorate, the same institution where Lithuanian based companies complete their tax registration and tax compliance obligations.

It is important to know that foreign companies can register online for VAT purposes. The registration is done by completing the Form FR0388.

According to the law, it is necessary to complete this procedure with minimum 3 days before starting any taxable activity. Companies must submit the following documentation:

- the company’s VAT certificate, issued by the country where the company is registered;

- the company’s incorporation papers (the articles of association, for corporate entities);

- an extract from the Commercial Register operating in the country of origin.

Please mind that the Form FR0388 is for VAT registration only. According to the Lithuanian tax institution, companies that must register for VAT have to register first as taxpayers in Lithuania, which represents a separate procedure, completed through other forms.

It is also worth knowing that if a foreign company plans to develop commercial activities in Lithuania only on a temporary basis, it may be necessary to complete VAT formalities as well.

The obligation to register as taxpayers as a foreign entity is imposed to both natural persons and corporate entities developing taxable activities.

The first step that must be completed is to register in the Register of Taxpayers by completing the Form FR0227 (for legal entities). Companies have the possibility to register online but also in person.

As presented above, foreign companies must present certain documentation from their country of residence. All these papers have to be translated into Lithuanian, with the assistance of an official translator.

Our team of consultants in company formation in Lithuania can put you in contact with local a translator and a notary public.

The VAT registration formalities for non-EU based companies will be completed with the assistance of the fiscal representative appointed in Lithuania. In this case, the fiscal representative must present a power of attorney that will show the person has the legal power to represent the company.

The power of attorney must be certified in front of a notary public. Other documents that must be submitted should comply with the rules of the Order 221 of the Minister of Finance.

What are the regulations on VAT registration in Lithuania in 2024?

Entities that are VAT payers will generally have to register for VAT in certain situations and after certain income levels are achieved. Those who will open a Lithuanian company will most likely have to be registered for VAT, and you can find out when this is required from our consultants.

According to the Ministry of Finance of the Republic of Lithuania, entities that charge VAT on their services or products sold on the local market have to register for the payment of the VAT.

In general, VAT registration in Lithuania was mandatory only after the income obtained from business activities was above EUR 45,000 on a financial year. However, starting with 1 January 2024, the threshold for mandatory registration has been increased to EUR 55,000. The purpose of this new tax policy is to provide small businesses with the possibility of reducing their tax burden for a longer period of time (until they reach the new threshold).

It must be noted that in 2024, non-resident businesses do not have to comply with a certain threshold for VAT registration. However, there is a minimum threshold, of EUR 10,000, for companies that provide digital services across the EU space, Lithuania included. For intra-community acquisitions, the VAT registration threshold available for 2024 is EUR 14,000. More information on other amendments of the VAT procedures applicable starting with 2024 can be offered by our consultants.

We invite you to watch a short presentation on VAT in Lithuania:

Please mind that the requirement to register for VAT is not limited solely to Lithuanian tax resident entities, natural persons or legal entities. The VAT registration in Lithuania can become mandatory for foreign companies operating on the local market.

In this case, they may need to obtain a non-resident VAT number. You should also know that the obligation to register for VAT is imposed in the case of intra-community acquisitions, where the minimum value is of EUR 14,000.

In certain situations, foreign entities trading goods or services on the Lithuanian market have to be registered for VAT purposes in order to provide information on the transactions that they have completed in this country.

The obligation for VAT registration in Lithuania can appear in specific situations that are prescribed by the Lithuanian tax law, as well as the EU’s directives of VAT. Some of the main scenarios are presented below:

- • VAT registration is necessary when an entity imports goods into Lithuania from outside the European Union (EU);

- • the procedure is mandatory when selling or buying goods on the Lithuanian market;

- • one has to register when the activity of the company is to sell goods from Lithuania which are sold to other markets;

- • the purchase of goods from other EU member states can lead to VAT registration in Lithuania;

- • holding products in consignment or as inventory on the Lithuanian territory;

- • those who want to open a company in Lithuania as an e-commerce business are also required to register for VAT;

- • the same applies to foreign companies selling goods on the internet to Lithuanian consumers.

What are the VAT compliance requirements in Lithuania?

Those who are legally required to proceed to VAT registration in Lithuania will have to comply with specific procedures, which are established for all VAT payers.

First, one has to know that a tax period in Lithuania is the calendar month. However, the possibility of paying the VAT on a quarterly basis is also available for specific categories oftaxpayers.

For instance, this applies to those who will open a Lithuanian company as a services provider in the online environment. Companies in Lithuania may also need to submit an annual VAT return, provided that there is the need to calculate VAT adjustments.

As a general rule, for a month where an entity has to pay VAT, the VAT return will be submitted by 25th of the next month.

Those who will submit VAT returns on a quarterly basis are expected to submit the required papers by the 20th of the next month after the end of the tax period (for instance, for the period of January – March, which is known as the first quarter of the year, the VAT return for the entire period will be submitted by 20th April).

Legal entities that can submit semi-annual VAT returns have to prepare their VAT documents by the 25th of the first month following the end of a period (documents on activity of January-June will be submitted in July and for the period of July – December, in January, the next year).

However, for those that need to submit annual VAT returns, the period in which they can prepare the required documents that show what VAT adjustments have to be made, will be deposited by 1st October of the following year.

If you need more information, you can rely on our team of consultants in company formation in Lithuania, who can explain at length other relevant matters concerning the obligations companies have on VAT returns.

Our team can also help you in the process of opening a company in Lithuania, register for taxes and obtain the necessary business permits.

Complying with the VAT in Lithuania

In order to become VAT compliant, a Lithuanian company must register with the tax authorities when the company registers with theTrade Registeror after a threshold of income has been reached.

The company will be required to collect the VAT and forward it to the tax authorities by filing monthly VAT reports with thelocal tax office.

In order to collect the VAT, the company is required to issue invoices which indicate the rate and the amount of money collected as a value added tax. Lithuanian companies must also comply with the EU’s directive related to the payment and collection of the VAT.

The rates of the VAT in Lithuania in 2024

The Lithuanian value added tax is imposed at various rates depending on the goods and services provided by companies operating here. If you want to open a company in Lithuaniaand you need advice on the categories of VAT that you will be liable to, you can refer to our consultants.

The following VAT rates apply in Lithuania at the moment:

- • the standard rate which applies to most products and services is established at 21%;

- • a reduced rate of 9% applies to good and services like local transport and tourism services;

- • a reduced rate of 5% applies to pharmaceutical products and medical equipment;

- • a 0% rate applies to the import and export of intra-community products and international transport activities;

- • a 0% VAT rate was charged for Covid-19 vaccines or services related to medical diagnosis on Covid-19, and this VAT exemption was applied by 31 December 2022.

In order to collect the VAT, companies in Lithuania must register with the tax authorities. Foreign investors can rely on our local advisors if they want to open a company in Lithuania. Our consultants can also help investors in the formalities concerning VAT registration in Lithuania.

Starting with 1st January 2021, electronic newspapers, magazines and other types of periodicals will benefit from a super reduced VAT rate, of only 1,5%; the same rule applies to printed materials where more than 4/5 of the entire publication contains paid advertising.

Please mind that under the latest tax regulations, the Lithuanian authorities have decided to maintain the 9% VAT rate for the accommodation industry throughout 2024 as well, and for the following years (the tax is to be maintained on an indefinite basis).

A new change brought by the new tax law is that e-books and other electronic non-periodicals will be taxed with the reduced 9% VAT rate instead of the standard VAT rate of 21%, in 2024 and in the following tax years.

For accounting services related to the VAT and assistance in setting up a company in Lithuania, please contact our local company registration representatives. Our team can also help with services for VAT registration in Lithuania.